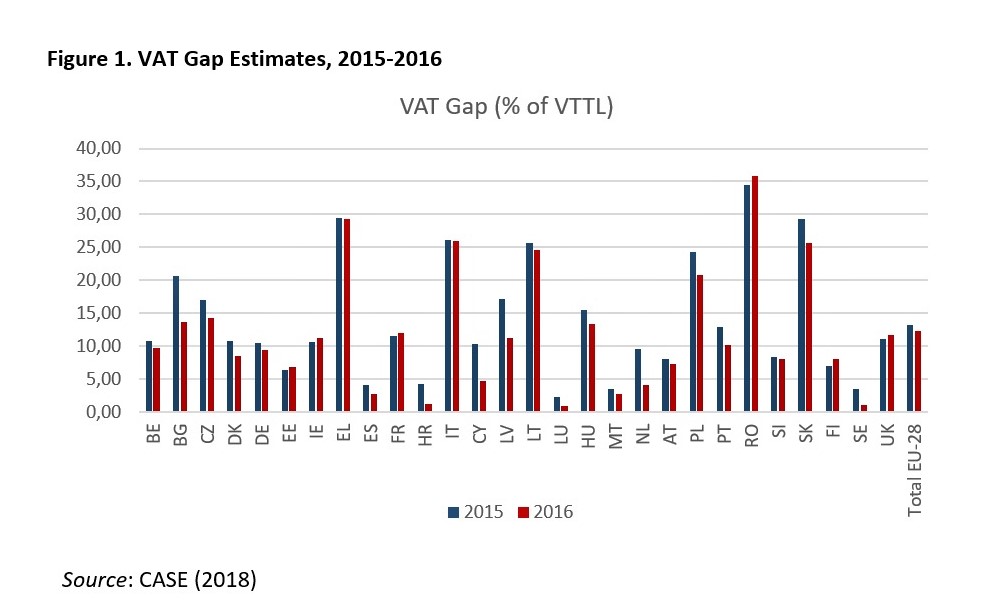

The difference in the estimate of the VAT gap in the EU* countries for... | Download Scientific Diagram

Non-compliance costs Europe €168 billion in VAT revenues in 2013 - CASE - Center for Social and Economic Research

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

PLOS ONE: Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach

EU Tax & Customs 🇪🇺 على تويتر: "#VAT Gap (difference between expected and collected VAT revenue) per country. More stats > https://t.co/LLdVPzqUTB… "